There is a less well -known opportunity for companies that buy goods at the international level, especially from China, to reduce their costs that have fallen and reduce customs tariffs. We will explore the option known as “first sale” in this article.

Also read: The effect of customs tariffs on emerging market trade flows

We have succeeded in many “first sale” links that provided savings of 10-20 % of the costs of customs clearance to the United States.

Importers looking for opportunities to reduce the costs that have been declined should evaluate whether the opportunity to benefit from the “first sale” must judge the borders and customs protection (CBP) that may be open to them.

Basically, the program admits that many foreign purchases are not carried out directly with external factories, but through brokers, often referred to as “purchase agents”.

CBP opens the door of opportunities in some import transactions where fees or commission paid for the mediator can be deducted from the declared value to CBP. This makes the “first sale” base very useful in alleviating the customs tariff and reducing the costs that have been dropped.

Do not assume, however, that the announcement of the first sale applies to all purchases through the mediators. Check with qualified consultants, lawyers, and Customhouse’s brokers to ensure compliance.

Access to the program may be difficult and requires the next steps to meet all the requirements that CBP may challenge you in:

- You will need to bring the manufacturer and medium to the first sale process, which may require some dangerous and crowned requests, where the disclosure will be revealed

- You need to evaluate the supply chain hard to make sure that you can use the first sale and compliance.

- Importers must comply with all CBP regulations, expected auditing with intensive documents procedures and memorizing books.

- In addition, this will require full cooperation and support from the manufacturer, the purchase agent/mediator/your CustomHouse Broker.

- The burden of proof with the importer lies to provide sufficient documents that support the use of the first sale value. This requires memorizing fine books and managing operations.

- Keep in mind that CBP, in assessing your use of the first sale option, may not agree.

- You can always get a binding decision from CBP proactively or in most cases using the resources of consultants and lawyers who specialize in commercial compliance. Experienced CustomHouse brokers may also be useful in the first sale process.

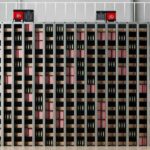

- The photographer below is depicted by ASIS surrounding the first flow of export/import transactions:

conclusion

The first sale doctrine of companies helps reduce the values and definitions that are imported when importing goods to the United States. Using this tool, importers can get the market feature, increase profitability, and manage the “landing costs” better. Compliance and comprehensive documentation is very important to increase benefits and reduce risks.