Economic activity in the logistical services industry expanded in August – but only marginalized and is characterized by a conflicting activity in warehouse and transportation standards.

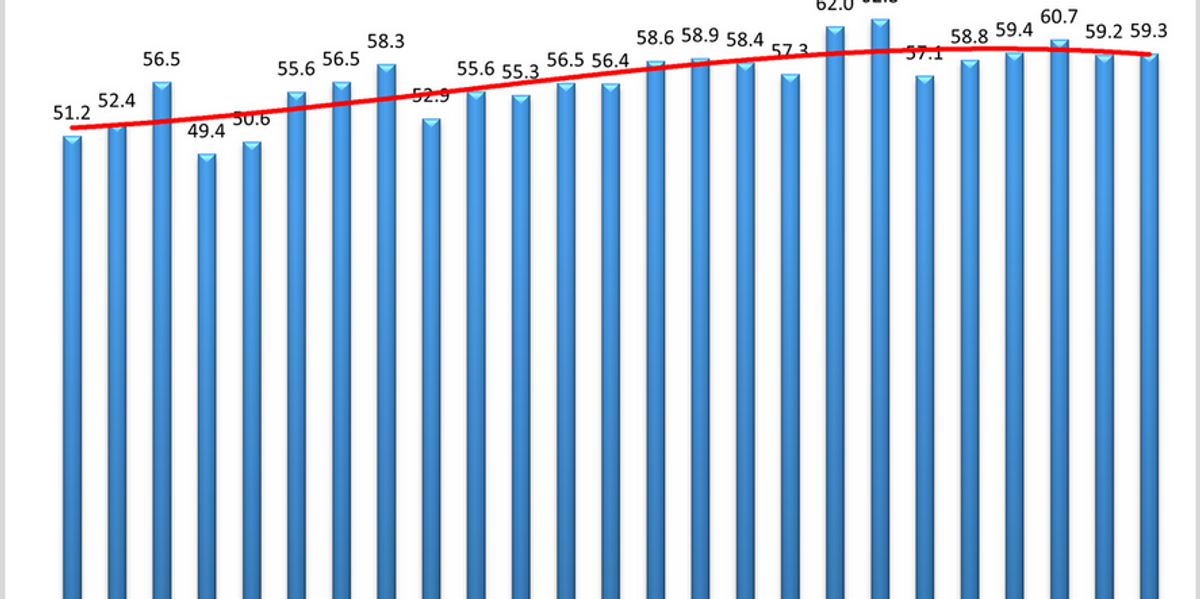

This is according to the recent LEMI (LMI) index, which was issued this week. August LMI 59.3 remained, a slight rise in reading 59.2 July and less than the average index ever of 61.5. The results are a moderate rate of expansion throughout the industry, according to researchers in LMI.

The LMI report relies on a monthly survey of logistical service managers at the country levels measure commercial activity in warehouse and transport markets. LMI reading above 50 indicates expansion, and reading less than 50 indicates a shrinkage.

The researchers said that the minimum LMI total movement in August was the result of the increase in the costs of the inventory that the diverse shipping market reduced. Inventory levels expanded nearly three points, which paid the stock costs and storage prices, which rose seven points and four points, respectively. At the same time, the storage capacity expanded only marginally.

The downward pressure came from noticeable decreases in both transportation and transportation prices, which fell seven points and five points, respectively. At the same time, the transport capacity increased approximately 5 points.

The 12 -month expectations of the report call for the continued expansion throughout the industry, as the respondents expect that the activity will be “somewhat” through the supply chain, according to the report.

LMI is a monthly survey of logistics managers from all over the country. The growth of the industry in general and through eight areas: stock levels and costs; Storage, use, and prices; The ability to transport, use, and prices. The report was released monthly by researchers from Arizona State University, Colorado State University, the Rochester Institute of Technology, Rutgers University, Nevada University, Renault, in conjunction with the Board of Directors of the Supply Series (CSCMP).