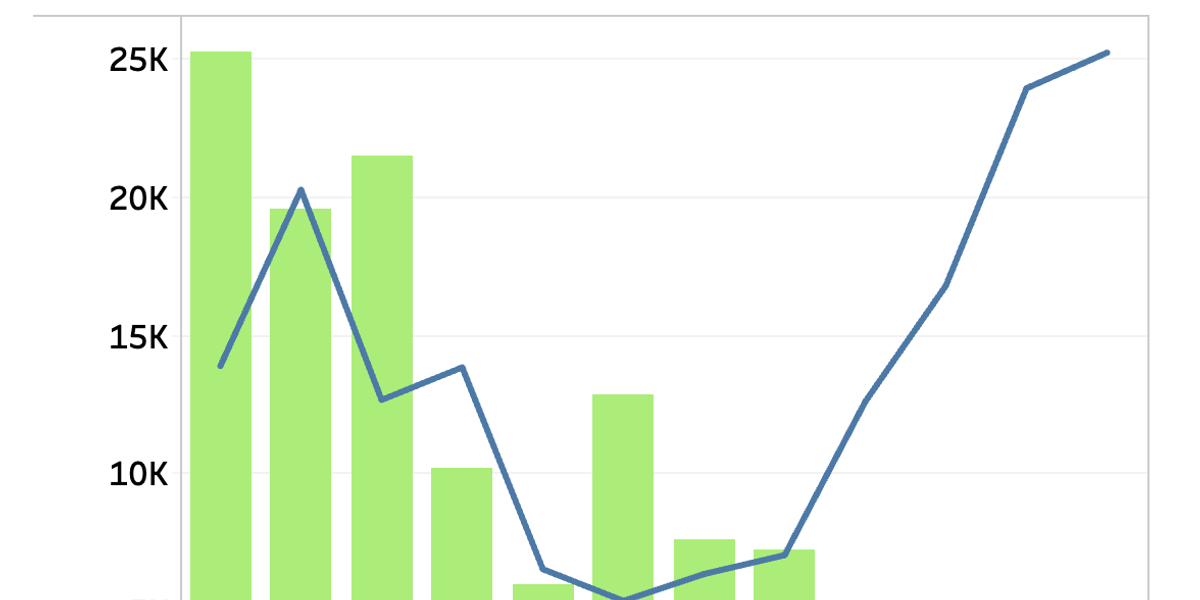

The total net requests in the United States reached 7,261 units in August, a decrease of 4 % monthly month (M/M), where the demand was weight due to poor charging, customs tariff pressure, and uncertainty in prices, according to the prediction company to transfer shipping in Indiana.

The number of requests actually increased by 3 % compared to the same month last year, but it remained much less than an average of 10 years in August of 17568. FTR said another reason for this weakness is the cancellation, which fell to 16 % of the aesthetics, decreasing than the peak of May (39 %) but it remained slightly higher than long -term standards.

For the full 2025 applications season (September 2024-August 2025), total net commands amounted to 188,519 units, a decrease of 5 % on an annual basis. For 2025 so far, net requests increased by 28 % on an annual basis at 110,080 units, average slightly over 13,750 per month. This force reflects the rear loaded requests after the November 2024 elections, which inflated the activity in the first quarter of the year.

“While continuing the designs that surpassed new orders, OEMS faces increasing pressure to balance the pipeline. Unless the application activity is with the opening of requests for requests 2026, the opposite winds that go to next year may face the additional winds that go to next year.”

“For trailers’ manufacturers and suppliers, the definitions produce costs, the most strict margins, and increase the risk of integration,” Muir said. “The largest and integrated players are more flexible, while the smaller companies are weak. Many fleets delay alternatives, more dependent on used trailers and expansion. The demand season 2026 may start later in September for some original equipment with defeated reservations as uncertainty in politics and structurally higher costs on demand.”