US container imports fell 6.6% year over year in September, signaling the beginning of a deeper, more sustained decline in maritime trade as tariff pressures and shifting supply chains take hold.

Read also: US imports decline 8.4% as Chinese trade volumes decline ahead of tariff deadline

According to industry analyst John McCown, the 10 largest U.S. ports saw their biggest declines since early 2024, after modest gains of 0.2% in August and 3.2% in July — months fueled by importers’ rush to beat new tariff deadlines. Previous months have already shown contraction, with volumes falling by 8.3% in June and 6.6% in May.

“The volume of imports into the United States will show consistent and more pronounced year-over-year declines next year in the absence of any changes to current tariffs,” McCown warned.

A temporary cushion came from a grace period that allowed goods already at sea before August 7 to enter duty-free if they arrived at US ports by October 5. This exception mitigated the impact in late summer, especially for long-haul shipments from Asia to the East Coast.

Global supply chains are rapidly regenerating

McCown noted that companies are moving faster than expected to restructure supply networks in response to rising US tariffs.

“If a manufacturing location was not attractive before because of a 10% rise in costs, it suddenly looks attractive if it avoids a 25% tariff,” he said.

This reorganization is reflected in the global container data. While inbound traffic to the United States declined, container volumes around the world hit record levels for two straight months through August. Exports from the Far East rose 4.6% year-on-year, with strong import growth in Africa, the Middle East, India and Europe – a stark contrast to weak US demand.

Double-digit decline in the future

After a 15.2% increase in 2024, the National Retail Federation now expects U.S. inbound container volumes to decline by 3.4% in 2025, with the last four months of the year down nearly 16% compared to 2024. McCown agrees that the decline will intensify, predicting that “double-digit declines in most U.S. ports” will continue through 2026.

The Port of Los Angeles posted a 7.6% decline in September — slightly better than its manager’s 10% forecast — while August CTS data showed a 9.9% decline in total North American imports.

Tariffs and duties ramifications

The latest contraction comes even as reciprocal tariffs on Chinese goods remain on hold until mid-November. However, President Donald Trump has threatened to impose new 100% tariffs on Chinese imports, raising concerns about the market as China remains the dominant source of incoming US containers.

Adding to the uncertainty, the US Trade Representative’s ship tariff plan, targeting ships built or operated by China, took effect on October 14. Beijing quickly retaliated by imposing similar port fees on ships connected to the United States. While only a few US-made ships are directly affected, the provision regarding companies 25% owned by the US could significantly widen the scope of the fallout if strictly enforced.

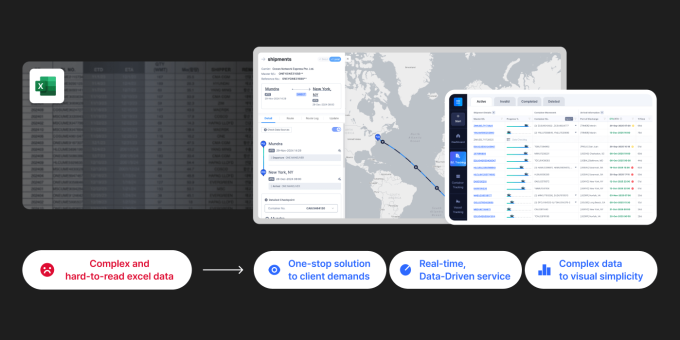

“The sheer number and complexity of tariffs is a growing problem,” McCown said. “It affects liquidity at terminals and within individual supply chains.”

Reshaping the business landscape

As manufacturers and logistics operators adapt, the United States appears to be entering a prolonged phase of trade contraction and supply chain diversification. With container flows shifting to other global markets and rising tariffs looming, analysts warn that next year could represent a crucial reorganization in how and where goods move around the world.