The perfume industry has quietly become one of the most dynamic sectors in global trade. What was once a niche segment of luxury fragrances is now an expanded ecosystem that includes home fragrances, car fragrances, essential oils and personal health products shipped across every major market. From design studios in Europe to fulfillment centers in Asia, the scent journey has transformed into a sophisticated global supply chain worth billions.

Read also: Circular supply chains: how sustainability is redefining global logistics

It’s not just about products that smell good, it’s also about how international logistics, sourcing and manufacturing are evolving to support an industry increasingly driven by emotion, identity and sustainability.

The expanding market for everyday scents

The fragrance has been defined by fashion houses and luxury brands. Today, scent has become an everyday lifestyle choice. The growing consumer appetite for ambiance and wellness has transformed the market into something much broader – encompassing candles, diffusers, sprays, and personal ambiance enhancers.

Recent trade reports show that the global fragrance and flavors market has exceeded US$30 billion and continues to expand rapidly, largely due to increasing demand in North America, Europe, and Asia-Pacific. The pandemic has accelerated this transformation; As people spend more time at home, the “wellness economy” has boomed. Consumers have begun to associate scent with mood, comfort, and even productivity.

This development has prompted manufacturers and distributors to expand operations, diversify sourcing strategies, and streamline international logistics. The result: a fragrance supply chain that rivals electronics or clothing in terms of complexity and reach.

Behind the scenes: The scent manufacturing pipeline

Unlike most consumer goods, perfume products rely on both artistry and chemistry. The raw materials – essential oils, plants and synthetic aroma compounds – are sourced from multiple regions around the world. Lavender may come from France, sandalwood from India, and citrus oils from Brazil. These materials converge in manufacturing centers specialized in mixing, packaging and packaging.

Producers must deal with fluctuating raw material prices, environmental constraints, and changing trade regulations. As sustainability and traceability become key requirements, many companies are adopting new technologies such as blockchain-based ingredient tracking to verify sources and authenticity.

Once production is complete, packaging facilities in Asia and Europe handle large-scale packaging, labeling and logistics. Finished goods then move through distribution centers in major trade corridors – such as Rotterdam, Singapore and Los Angeles – before reaching retail markets around the world.

Home fragrance: the new cross-border commodity

Among all categories, home fragrance is one of the fastest growing product segments in global trade. It represents the intersection between lifestyle, health and consumer behavior, a convergence that multinational retailers can no longer ignore.

Cross-border e-commerce shipments are now dominated by products such as candles, diffusers, and plug-ins. Global buyers source from manufacturers in China, Thailand and Turkey, while boutique producers in Europe and the US export high-end small batches through direct-to-consumer platforms.

Consumer interest in home wellness has transformed the industry. From luxurious candles to simple aromatherapy devices like modern ones Home scent diffusercompanies are expanding production to meet the growing global demand for sensory-driven living spaces. This shift has also created new opportunities for logistics providers – specialized shipping services for temperature-sensitive essential oils, transportation of safer chemicals, and packaging designed for long-term e-commerce distribution.

Global Logistics: When fragrance meets shipping

Smell shipping isn’t as simple as moving clothes or electronic devices. Essential oils, alcohol sprays, and diffusers often fall under the classification of “dangerous goods” due to their flammable components. This makes compliance, mobilization and route planning crucial.

Manufacturers rely on a hybrid logistics strategy:

- Air freight For small luxury items and perishable oils.

- Sea shipping For mass market publishers and bulk components.

- Ship docking To achieve regional fulfillment and rapid delivery of e-commerce.

Warehouses equipped for storing cosmetics and perfumes must maintain temperature control and hazard certification. These operational layers add complexity, but also create new opportunities for logistics companies that specialize in sensitive, high-value shipments.

Many shipping operators now offer integrated solutions tailored to the fragrance sector, including packaging, labeling, customs compliance and even product registration for import markets.

E-Commerce Factor: Trade scents directly to consumer

E-commerce has reshaped how fragrance products move through the entire global supply chain. Direct-to-consumer brands are bypassing traditional distributors, using fulfillment partners and regional warehouses to handle international demand.

Cross-border platforms now allow small fragrance startups to ship worldwide with minimal overhead. AI-based demand forecasting tools help manage inventory levels, reducing waste associated with overproduction. Meanwhile, integrated trade software automates export documentation and customs declarations, allowing even small brands to compete on a global scale.

Platforms that provide seamless global payment processing, regional payment support, and fast delivery options have become essential infrastructure for perfume exporters. As more consumers seek custom or niche scents, the long-lasting fragrance market has grown significantly, creating new trade corridors in previously underrepresented regions such as Eastern Europe, the Middle East and Southeast Asia.

Sustainability and ethical sourcing in the perfume business

Consumers are becoming increasingly aware of how their products are manufactured. Transparency, eco-friendly sourcing and sustainable packaging now define success in the global scents market. Major perfume houses are embracing circular economy principles, such as reducing packaging waste, reducing carbon footprints, and choosing renewable ingredients instead of synthetic materials.

At the supply chain level, sustainability affects trade routes and purchasing decisions. Producers prioritize ethical partnerships and local sourcing to reduce environmental impact. Certifications such as Fair Trade, RSPO (for palm-based ingredients) and ISO standards have become standards of credibility in the international perfume trade.

And even logistics providers are adapting – using carbon-neutral shipping options, recyclable materials, and blockchain-led tracking systems to support sustainability goals across the entire value chain.

Technology and innovation are driving the future of the perfume business

The intersection of technology and scent creates a whole new business ecosystem. From IoT-enabled publishing devices to AI-driven fragrance design, the industry is merging creativity with data. Smart devices can now analyze room conditions and automatically emit a blend of scents, bridging the gap between personal health and connected living.

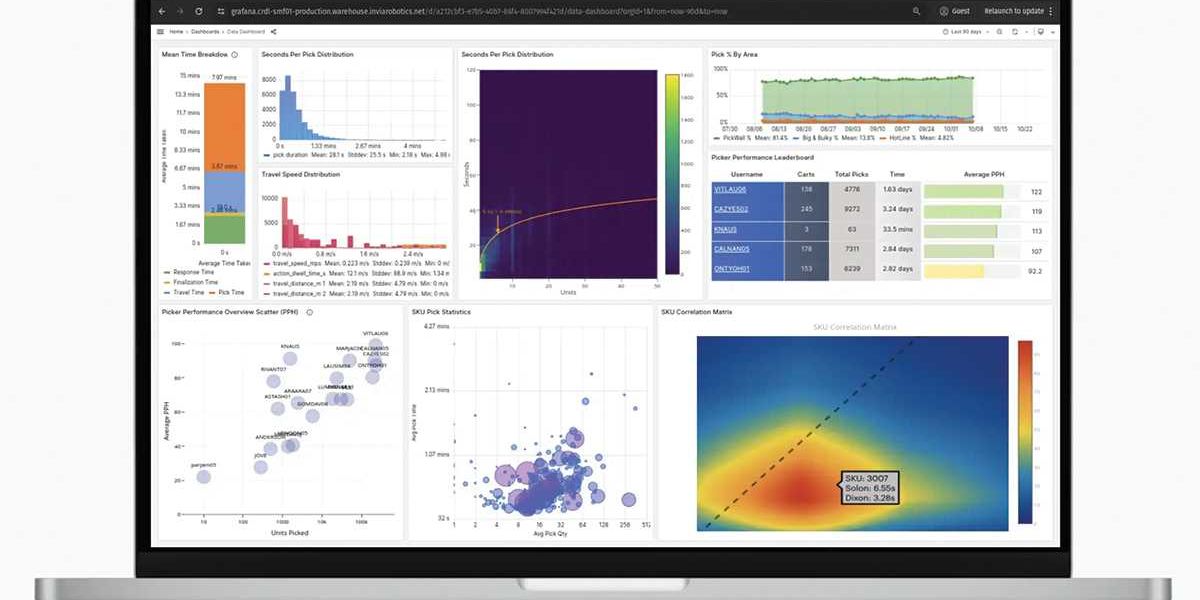

Manufacturers are also leveraging automation and digital twins to improve production processes and forecast demand more accurately. Predictive analytics help identify emerging aroma trends in specific regions, enabling producers to customize exports and reduce unsold inventory.

For global trade, this data-driven approach translates into efficiency and competitiveness. It ensures that every shipment, from factory to retail shelf, matches real market needs rather than outdated forecasting models.

The perfume industry may seem intangible, but its business dynamics are deeply rooted in tangible logistics, sourcing, and innovation. What began as a niche luxury category has evolved into a global network of suppliers, shippers and consumers – all connected by the universal language of scent.