The container shipping sector enters a period of structural amendment, as the capacity of the bowl, the decline in shipping rates and the transfer of global trade routes to reshape commercial dynamics.

According to Funson Bahri Shipping market forecast for Q3 2025and The ability to adapt and Cost efficiency It will be central to move in the coming months.

The global shipping market is still defined by Geopolitical tensionsand Trade disturbances and Overage economic uncertainty. Outlook at Veson Nautical Q3 2025 highlights how these pressures are sharply operating in the container sector, which faces increasing challenges after a period of rapid expansion in the fleet.

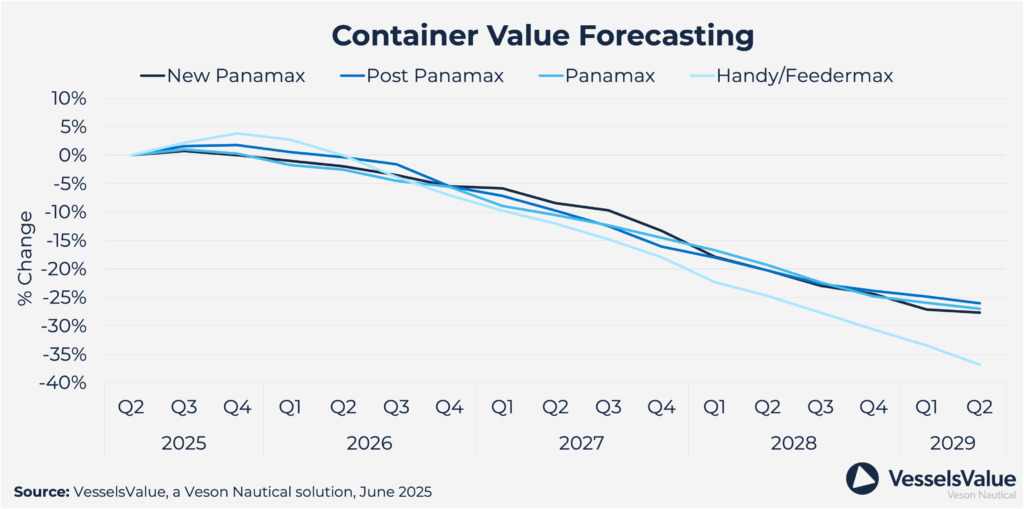

The net container fleet was expanded by 5.5 percent in 2023 and 9.7 per cent in 2024, with an annual average of 8.2 percent from 2025 to 2028. This acceleration was driven by a standard arrangement in 2024That almost seen 4.3 million twists add to the request book. As a result, a notebook to Fleet was 31.1 percent, an unprecedented level in recent years.

Read: Veson Nautical platform, great eastern shipping reveals the iMOS platform

One of the prominent trends is a shift in demand preferences, with growth Stay away from New-Panamax Ships In favor of the large high containers’ containers (ULCVS). This reflects advanced global trade patterns and a constant focus on savings.

Despite this growth, New orders were sharply slowing in 2025As the costs of building high ships and the saturated request writings new activity. Veson notes that this is likely to reduce the pressure on the coffee basin capacity in the medium term.

On the abandonment front, the activity is still defeated but it is expected to increase, especially among the smaller ships less than 3000 of TEU. These old ships have become less applicant with an increase in operating costs and shipping rates have decreased.

Read: The requests for applications indicates the provision of supply in the heads market

Beyond the containers, Veson’s marine notes are constantly fluctuating in Tanker marketsDrivated with red marine tensions and European Union sanctions on Russian oil that re -trade flows Request a ton of mile. However, the carrier Fleet growth It is expected that The demand for the range after 2025 Because of the new delivery processes and low mitigation, with regulatory pressure and changing oil consumption patterns, adding uncertainty in the long run.

Likewise, the Polker sector Benefit from pEducational request books and Emerging trade methodsSuch as increasing iron ore shipments from Guinea, and support for tin mile growth despite the most softened demand associated with the economic challenges of China. The geopolitical risks still affect the vascular redirect and shipping rates, even with the total activity of the arrangement across sectors amid new construction costs.

With the passage of mid -2025, global maritime trade finds itself in turbulent waters, not storms or tidal, but from political geography.

In order to explore an in -depth of how to reshape these dynamics, read our exclusive analysis: Political geography in the sea: movement in the storm in 2025