Economic activity throughout the logistics industry expanded in July, driven by a strong activity between the intermediate miles companies that bear efforts to stay at the forefront of uncertainty related to trade, according to the LEMI’s LEMI’s report, which was issued today.

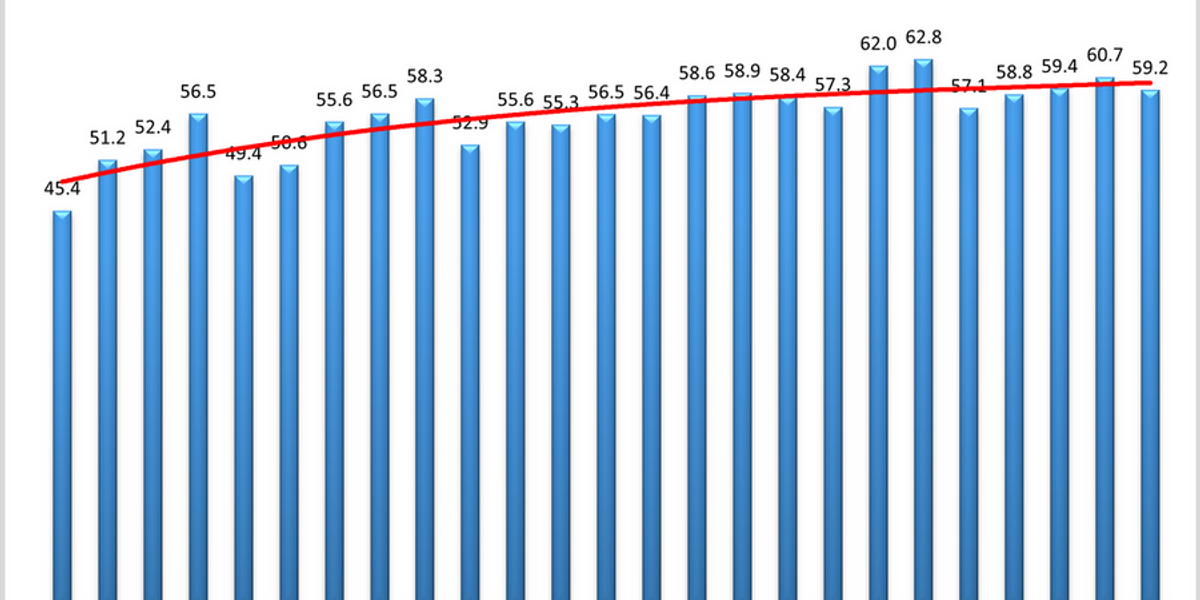

LMI 59.2 in July recorded a decrease from the reading of 60.7 June, but still indicates moderate expansion through logistical services markets. LMI degree depends on a monthly survey of logistical services managers at the country level and tracks transportation and storage. LMI reading above 50 indicates expansion in the sector; Read below 50 indicates contraction.

The July report follows a strong activity between upstream companies and smaller companies – many of whom are wholesalers, distributors, and logistics service providers who suffer from higher stock levels and more strict capacity compared to their retail counterparts. These are moderate miles that were stored before the final dates of the tariff as an unconfirmed economic climate.

The researchers at LMI wrote in their report in July, pointing to the degree of LMI, 62, the smaller companies: “Continuing the direction that we have noticed during the past three months, the logistical expansion is driven inappropriately by the smaller companies …”. [smaller firms] They keep the high levels of the stock that was brought to the United States to avoid definitions, but it has not been transferred to retailers yet. Calculating these stocks is high, but the idea is that they will act as temporary stores for the current insecurity. “

In comparison, large companies and retail dealers towards the river course report the contract lists, more capacity, and expand low prices while trying to maintain time management strategies to avoid high costs, according to the report.

On the transfer side, LMI standards reveal a “contract pattern” in the recharge recovery that started last year, as the use of transportation increased but the capacity and prices remained consistent with June readings.

The future view of the 12-month report calls for continued expansion through logistical services, as the respondents expect LMI to generally grow 62.6-reading decreased slightly from June but above the average prediction of future growth at all of 61.5

LMI is a monthly survey of logistics managers from all over the country. The growth of the industry in general and through eight areas: stock levels and costs; Storage, use, and prices; The ability to transport, use, and prices. The report was released monthly by researchers from Arizona State University, Colorado State University, the Rochester Institute of Technology, Rutgers University, Nevada University, Renault, in conjunction with the Board of Directors of the Supply Series (CSCMP).